SuretyHR is a professional employer organization that specializes in helping Ohio employers manage their workers’ comp claim management. We ensure that your claims are identified early and handled with proper attention.

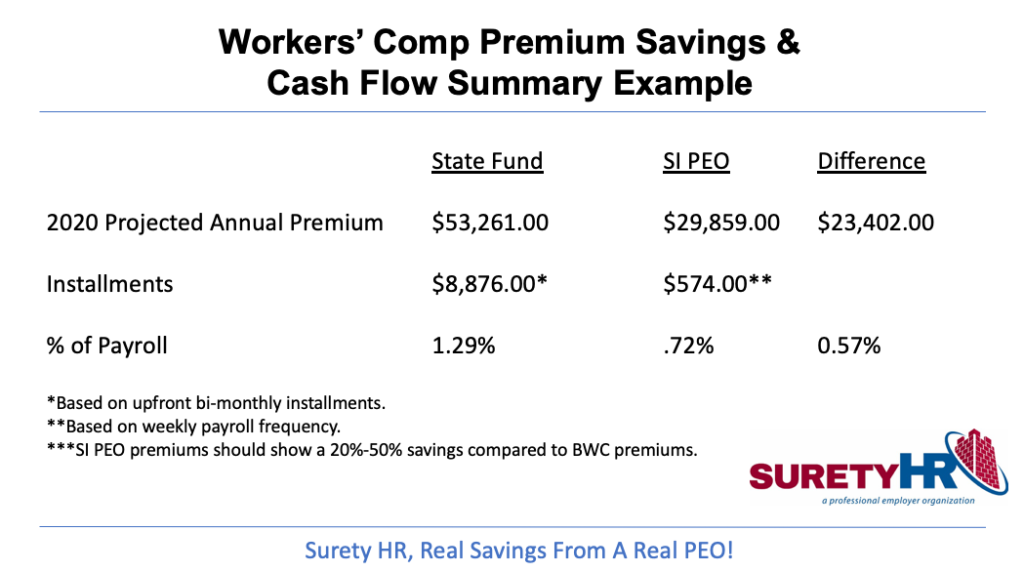

Workers’ Comp Premium Savings and Cash Flow Summary Example

In this video, we have an example of a state-funded premium versus an SI PEO. In 2020, the state fund premium is going to be $53,261, with a few options for installment through the BWC, whether you choose annually, semi-annually, or bi-monthly, which is the most common choice.

If we choose bi-monthly in this example, every two months, they are paying $8,876, and that is 1.29% of this example’s payroll.

For the SI PEO, the savings would be $29,859 per year for this premium. This comes out of the payroll frequency, and this company pays that weekly. That lowers the price down to $574 every week, which is .72% of payroll. That is a difference of .57% or savings at $23,402.

The savings in itself is big, and it’s important. But from a cash flow standpoint, think of a company that your premiums get larger, you’re paying more money upfront for the premiums instead of the money coming out of payroll, so it helps with cash flow.

Overall, this example shows you that the workers’ comp savings premium for a self-insured PEO compared to the BWC should be anywhere from 20-50%.

Contact Us

If you want to learn more about how you can save on workers’ comp premiums with a PEO, contact us at SuretyHR today.